There are good purchases. And then there are the really bad, ugly, regretful, worst purchases that leave a close range shotgun hole in your bank account.

My objective is to get your money working for you like a well-oiled machine and to save you from financial mistakes.

Because you’ll never reach financial freedom if you take one step forward and three steps backward. That doesn’t make sense.

But millions of people are in debt over their heads—that’s not an exaggeration. And the average household with credit card debt owes a balance of $16,748. That’s thousands of dollars a year in interest. Wow!

So why do people continue to commit these financial sins?

There are two guilty parties conspiring against your net worth. And these bandits are reckless. I mean truly despicable savages.

Criminal number one is this consumerism culture pushing the desire to always want something new and never be satisfied with what you have.

This culture is so intense nowadays that people attach their identity to what they have, not who they are as an individual.

For example, they feel good the day they get the new iPhone. But then the second the next one comes out and they don’t have it, they have anxiety. So they spend all their attention and money to get the newest one.

That’s just how they react for their phone. The same attitude exists in all of their purchases. And the bank account takes a beating daily.

You won’t like to hear this, but the second criminal in the manslaughter against your bank account is yourself. That’s right, the face in the mirror who has an intense desire to please and appease your loved ones and friends.

This concept falls in the same bucket as the “keeping up with the Joneses” disease that sweeps the world.

A Volkswagen commercial makes fun of one neighbor who continues to copy the other, but this reality is too true today.

Have your coworkers, friends, or family ever indirectly influenced you to buy something to keep up with them or a new trend? I bet they have. It’s human nature nowadays.

And don’t get me started on your shopping trips with your partners in crime to the mall. You all act like shopping friends, when honestly you’re all peer pressuring each other to waste money.

Can you tell I have strong feelings about this topic? Good, that’s the point.

Using your money for freedom is a serious issue. I’m going to come guns blazing on this one to get my point across.

While I believe sending money to anything that doesn’t make you money or cover necessary expenses is a waste, some purchases are more expensive in the long run than others.

Now I’m not saying the following 5 purchases don’t hold any overall value. But from a strictly financial viewpoint, these are the top 5 worst purchases that will blow up your finances.

5 Worst Purchases For Your Money

1. Home

Wait. Haven’t your parents, the media, and the government told you a home was a good investment, how you signal you’re an official adult, and the path to the American dream? They’re all wrong!

And this 38-year-old millionaire who said buying a condo was his biggest financial regret agrees with me.

Why is a home a bad investment? There are many reasons.

First, I look for investments that get at least 7% to 10% interest annually. Anything less than that isn’t worth my money or time.

I bet this will be shocking news to you: Home ownership produces a big fat 0% long-term return. When you include property taxes and interest rates, your home could produce a negative return—yikes!

I’m certainly never paying property taxes and interest rate taxes on my stocks, or buying stocks that get me a 0% return.

And when you compare a home to a soaring investment like Bitcoin, which has more than tripled in value for me (300% return in less than a year) then buying a home looks even worse.

Plus you have to pay interest on the mortgage, leaving you with less cash flow to invest in your future.

The biggest advantage to investing is getting started early and utilizing compound interest over time. But if your home sucks away that money then you can’t build toward financial freedom.

And then there’s the fact that buying a home ties you down to one location. This limits your mobility and your desire to take a higher paying job in another city because of the pain of moving out of your house.

Settling in one place makes it easy to get comfortable and become complacent with life, instead of striving for more.

The main point is buying a home is nothing more than a savings account. It’s not an investment that will consistently make you money.

Meaning you’re most likely sacrificing millions of dollars down the road because of your home purchase.

Think about that before you commit to a 30 year mortgage and $250,000 on a house as a young adult.

2. New Car

Who wouldn’t want to buy a brand new $30,000 car with a sleek design, flashy wheels, exquisite interior, and new car smell? I know I would.

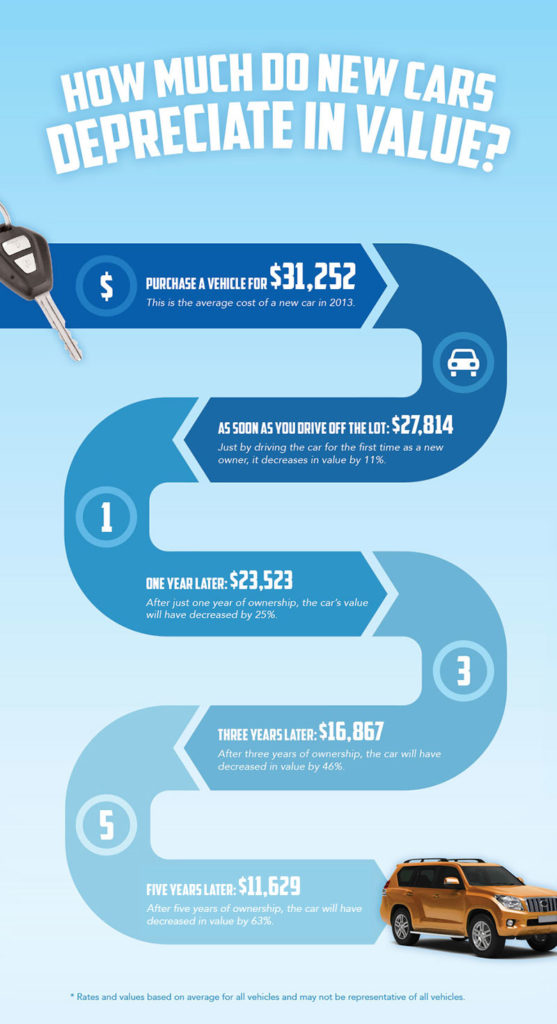

But buying a new car is like buying a stock on its worst trading day of the year. Because a new car value drops 11% the second you drive this shiny toy off the lot.

That 11% loss is nothing to take lightly. Then when you add the interest rate to the car loan, things only get worse.

Pretty soon you have a new car but no money for gas to drive it—that’s a joke but there’s some truth in it. New cars are sweet until you realize they’re a black hole for your money.

Don’t make the mistake of valuing what you drive ahead of your financial freedom and future. All cars become worthless eventually—where assets keep producing.

I recommend you follow Financial Samurai’s the 1/10th rule for car buying—which states that you spend no more than 10% of your gross annual income on the purchase price of the car.

Following this rule means to buy a $15,000 car you’d need to make a $150,000 income this year. Although it’s controversial (864 comments arguing back and forth on the article) I’m with Financial Samurai and his frugality.

Would you rather look sweet in your whip and be a slave to your bills, or go from point A to B in a used car with complete freedom? If it’s freedom you seek, a brand new car only gets in your way.

3. Boat / Motorcycle / RV / Plane

Buying a boat, motorcycle, RV, small plane, etc., is undoubtedly the wrong move to make as a young adult in your 20s.

Save that for later when you’re financially free and have more money to throw around.

Why should you wait to enjoy the pleasures of these vehicles? It all goes back to the power of compound interest. Any money you put into an expensive purchase like one of these is money that should be used to multiply your net worth.

And if you really have an urge, remember you can rent a boat, motorcycle, or RV for a week. It’s always cheaper to rent these vehicles than own!

This is the worst purchase on this entire list because all of them are unnecessary. The others are somewhat excusable because you need to have a roof over your head, to commute to work, to get dressed, and to not walk barefoot.

Sorry, I’m not sorry about killing your fun because I’m trying to save your money and freedom.

4. Expensive Clothes

Look, I get it. Fashion is trendy, it’s cool, and it inspires confidence.

Plus my sister, A Style Breeze, is a fashion blogger who loves dressing up and I sense the passion each time she talks about it. (Her and I even did a video together titled Look Good, Feel Good that explains the importance of looking good and its social benefits.)

But there’s a difference between looking presentable and balling out at the mall like you’re on a mission to spend as much money as possible. Surprisingly people act like that.

For example, there’s a cult following for these Supreme hoodies that cost around $150.

It’s not the most expensive thing in the world, but it’s just a sweatshirt that says the word “Supreme” on the front. And my frugal head doesn’t understand why people spend $150 to buy one.

Because the math and the money doesn’t make sense when you could invest $150 at a 10% return and reach:

- $389, 10 years later

- $1,009, 20 years later

- $2,617, 30 years later

- $6,788, 40 years later

- $17,608, 50 years later

You might laugh that I extended this out to 50 years later. But wouldn’t you rather retire at 70 with $17,608 of cold hard cash or have bought a hoodie 50 years earlier and have no idea where it is?

By learning about Warren Buffett’s mindset towards money and writing my own money book, I’ve learned you have to think this way about your money if you want to be wealthy.

The point is don’t try to dress like Kanye unless you have Kanye money. And even he needs help with his finances apparently:

A few quick tips to save money on clothes are to:

- Ask for clothes (and pick them out in advance) for your birthday and Christmas presents

- Borrow roommates’, friends’, or siblings’ clothes

- Get steals at Goodwill, Plato’s Closet, or other thrift stores

- Buy versatile tops and bottoms you can wear with anything

- Purchase based on need and appearance over name brands

5. High-End Shoes

Since they get worn down and lose value with each step, shoes offer weak long-term durability and that’s why they’re a worse purchase than clothes.

You can at least resell clothes and sometimes get 50% of the purchase price. But it’s extremely difficult to recover money from selling used shoes.

It’s best to think of your shoes like you would your car, just a resource to get you from point A to B.

Although the shoes are gorgeous, I’d never buy Yeezy’s ($1,000+) or Lonzo Ball’s new ZO2s ($495 retail) unless I checked my account and saw 8 figures looking back at me.

And wise girls would hold off on the high-end designer heels to find knockoffs that look similar but cost $30 instead of $300.

If you put your money into high-end shoes, be comfortable putting your money in dirt, rain, mud, and snow because those are the elements damaging your shoe purchase.

Where Are Good Places To Put Your Money?

I don’t want to write an article bashing places you put your money and then not give you any solutions.

Negativity and problem-finding is lame. Positivity and problem-solving is the game.

Here’s where to put your money if you want to financially get ahead in the game of life:

- Invest in yourself to develop your skills or education (includes coaching, online courses, and travel)

- Return is unlimited

- Buy shares of the S&P 500 Index Fund

- On average, you’ll receive 7% to 10% return year after year

- Start a money-making business

- Return is unlimited

- Purchase a rental property

- Return depends on purchase price and how many units you own

Those are four solid options right there to grow your net worth. Not a single one of them will give you 0% return on your money like homeownership.

And there are also tax incentives to putting your money in these assets. For example, capital gains from your stocks are taxed less than a W2 employee’s income, businesses are taxed less, and rental property offers many deductions to save on taxes.

The difference is all four of these investments are assets that will pay you money, where the home, car, boat, clothes, and shoes are all liabilities that will suck your money dry.

You have the information. Now the choice is yours.

Do you want short-term comfort and to feel proud in front of your family and friends that you can buy nice things? Or do you really want to commit to financial freedom and a successful future?

This answer is a foregone conclusion for me. I have all my chips in the pot, I’m all in, for financial freedom. And that’s why I’m going to get there soon.

If you want to join me, order my Amazon bestselling book Freedom Mindset. This will help make investing simple for you to understand and do yourself.

I believe in you. You can reach financial freedom!

Final Words

Not everything’s about money.

If you really want a home or a motorcycle because it’s always been a dream of yours, then just because it’s not a good investment doesn’t mean you shouldn’t get it.

For cases like that, I recommend you compromise and here’s what I mean.

Say your motorcycle costs $300 a month. To make up for this fun purchase, you increase your monthly investment contribution by $300 a month. Or you save 10% more of your income each month to counteract this splurge.

That way you’re not sacrificing your future. The motorcycle cuts away at your entertainment or eating out budget, not your money for investing or saving.

However, in terms of strictly a financial perspective, none of these purchases—home, car, boat, clothes, shoes—will be bank account positive.

And all of them (maybe besides a house), whether you admit it or not, are short-term moves for instant gratification. Cashing in for the short-term is no way to build wealth.

The way to get rich is to invest in assets, be patient, and continue to pour money into those investments like gasoline to a fire.

If it helps, I’ll be right there with you on the journey to financial freedom.

Related:

Very informative post! I’m curious about your thoughts on buying a home in an area where there’s an influx of transplants and an estimation of huge population gains that would eventually drive up housing costs? (Seattle, for example). Wouldn’t a home purchase be no different than investing in stock, but with higher gains?

Hey Krista, that’s an interesting point. Assuming you pick the right location and the estimation becomes accurate (two big ifs right there), you could definitely make money if your house appreciates. But I don’t see how you’re getting higher gains over the long-term, especially when you consider all the fees, maintenance, and property taxes eating away at your profits.

I don’t know anywhere where you can find a home that’s going to appreciate 7%-10% on an annual average for the next 40 years. Do you?

Well when you put it like that, no. LOL! You’re right though, definitely not a long term strategy. My house has appreciated 56% in 2.5 years. Not sure how long this wave is going to last, but I plan on holding tight for another year and re-evaluating.

I should probably look into investing some of the equity into a longer term strategy. Thx for planting the seed.

Congrats on the big win! That’s no small chunk of change.

Yeah I’d diversify and send some money to an S&P 500 index fund (such as ticker symbol VFINX). It’s about impossible to imagine a house price can keep up with businesses like Facebook, Amazon, Apple, etc. over the long term.

(P.S. I tried to leave a comment on your site and it returned an error when I hit submit. Maybe it was my computer, but I’d check into that.)

Brian – Thanks for the heads up on S&P 500, I’ll definitely be looking into that (and the error on my site, too!)